You may know Tony Robbins as a motivational speaker, self help coach, late night informercial guy, or from Personal Power. I personally remember always teasing my dad about how boring his 13 set cassette tape program on Personal Power. However, not knowing what a powerful guy he is. I haven’t really listened to any of his material much but recently I’ve listened to several interviews he’s done to promote his new book, Money, Master the Game, I’ve gotta say I’m a convert and a huge fan. The energy this guy brings whenever he talks really does just get you buzzing and gets you pumped up to take the world. In addition, hearing what he has to say about personal finance and money, I’m a big supporter of what he’s doing in getting the message out there about how to get out of the pitfalls of the system and keep more dollars in your pocket.

I read through a short blog that he probably didn’t even write on his website, but that follow some of the things he’s trying to teach people in his new book, and I thought it had some good points and wanted to get a bit deeper into it.

1 and 2. Know the Timeline and Gain the Advantage Through the Power of Compounding

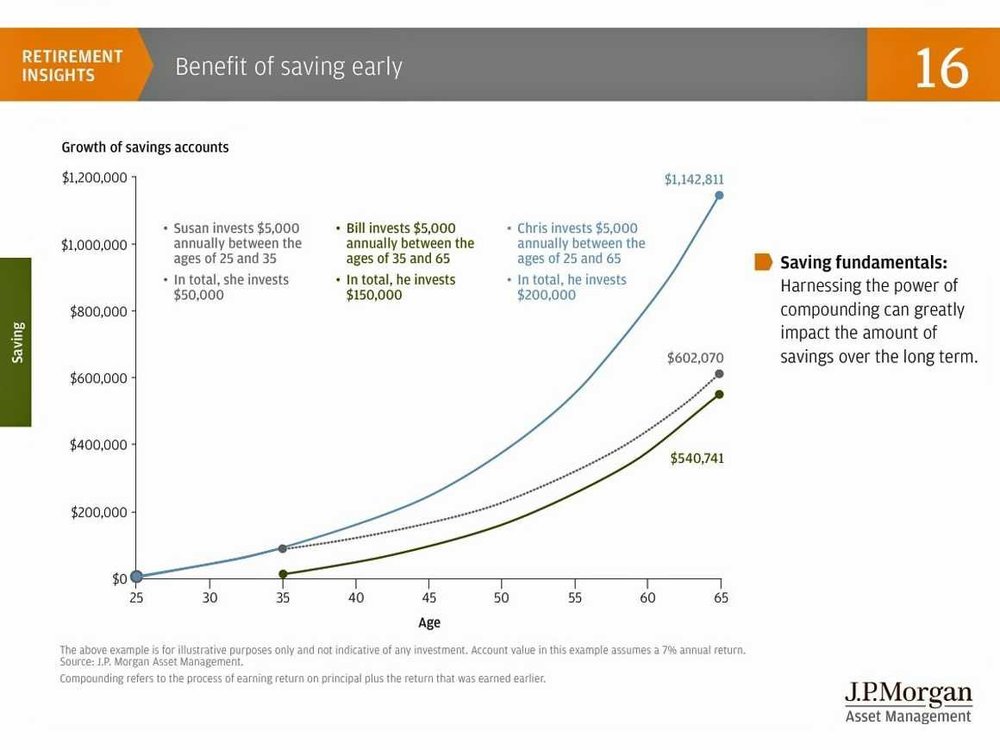

You’ve gotta learn the power of compounding. Just look at the below example:

Image from: http://www.businessinsider.com/amazing-power-of-compound-interest-2014-7

You see that the Susan invests 1/3 of the amount of Bill, but because she starts 10 years earlier, ends up ahead. You also see the power of the longer length of time to invest that Chris has, he gets exponential output.

3. Make Your First Move

What it means for us young people is that you need to start NOW. Don’t think “hey I can start saving when I make more”, because by then you’ll have already regretted it. The other thing is that saving is actually a skill that you need to develop. A practice of paying the cost now to benefit later. A practice of self control. A practice of making good decisions consistently. A practice of saving for a purpose.

The earlier you start, the exponentially better off you are later.

4. Automate It

This has got to be one of the best life hacks I learned from Ramit Sethi’s I Will Teach You to be Rich, which I highly recommend as my #1 pick for personal finance. Don’t force yourself to make bad decisions. It’s like wanting to eat healthier, but keeping the chocolate, candy, and chips on the counter or in the cupboard. If you give yourself the choice, you’re inevitably going to make poor decisions. It’s not a matter of self control, just have systems so you will never have to make a bad decision.

My work matches a portion of my RRSP contributions and puts it in a retirement account. Once in awhile I transfer those funds to a personal account where I have already decided exactly what I will buy (which is Berkshire Hathaway shares). I don’t need to set aside money from my pay cheque and have to physically do it, it’s already done and never even lands in my bank account. What ends up in my bank account I consider mine, and spend as I so please, because I already know my retirement savings is already covered.

If you don’t have this option, set up a Tangerine account. Link it to your chequing account. Set up an automated transfer. Once in awhile, buy shares of stock picker TSE:VFV as prescribed by Warren Buffet.

Start a sub-account called “Europe”. Set up a automatic transfer there once a month. Boom, just helped you book your dream trip.

5. Make the Impossible Shot

Actually I don’t know what this has to do with anything. But basically, if you don’t think you can do it, start with 5%. Just do it even if you don’t think you can afford it. You would surprise yourself what cuts you can make to get that 5%. Then once you do that for awhile and realize you don’t even notice it getting taken off the top, increase it more. And more, and more …

I’m generally not a big fan of lists, so this is in no way comprehensive. Just reviewing 5 points that Tony shared.

I’d love to hear what you think or if you have any feedback or criticism. Also if you need clarification, or don’t feel you understand it, let me know.

You have the power right now to change the course of your golden years, and the course of your financial future with your family. Do you dare try now?

Links:

Tim Ferris Podcast with Tony Robbins was phenomenal and was what turned me on to him in the first place. I would definitely recommend it.