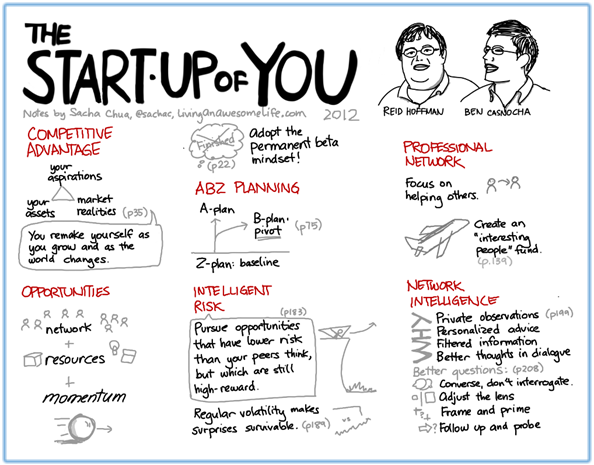

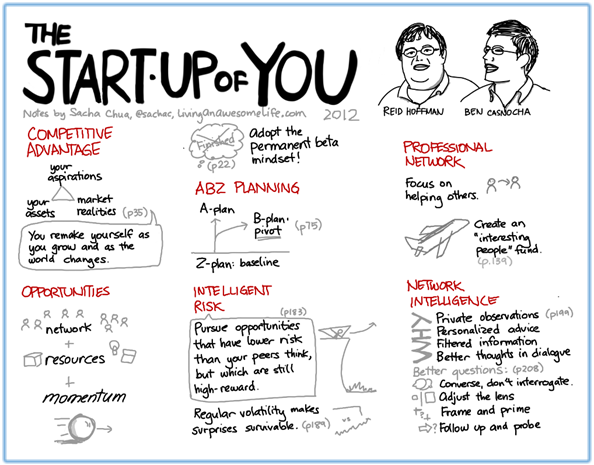

As an introduction, Reid Hoffman is often heralded as Silicon Valley’s Grandmaster. He was an original executive at PayPal (Paypal Mafia), co-founder of LinkedIn, and a partner at Greylock Partners group. I have not heard too much about him until reading this book and I must say I now will probably forever revere his thoughts on any subject. His ability to put together the material in this book has completely re-wrote what a career path in my mind looks like has given me great respect for his mind and ideas.

Ben Casnocha is an interesting co-author to this book. I remember Ben Casnocha from years ago, he was writing really popular blogs for young people / college students about really going out and gaining experience with cool internships, doing really cool and interesting projects, learning new things, and travelling abroad. I remember his writing had great impact on me for a period of time as a student. Since then I hadn’t heard about him in years, but have come to find out now that he worked under Hoffman for a couple of years, to help him strategize all the projects that he works on.

Intro

There is a new reality for those of us who want a meaningful and thriving career. Gone are the days of lifetime employment with the behemoths (ie. General Electric, Ford). The new reality is that feeling stability in a job is not about job security, because those that felt the safest are the ones that were impacted the most (ie. Wall Street 2008, and everyone else in 2008). Job security is no longer about the company you work for, but it is in your human capital, your ability to be entrepreneurial, create opportunities, take risks, and accomplish great tasks.

“The gap is growing between those who know the new career rules and have the new skills of a global economy, and those who clutch to old ways of thinking and rely on commoditized skills.”

“What’s required now is an entrepreneurial mind-set.”

Just like your product, your career should be in constant beta. You need to be iterating, gathering feedback, “adding features”, and always have a pulse on the market so you know where it’s going. In the product world, if you aren’t moving forward, you are moving backward, and you become irrelevant.

Competitive Advantage

You need to develop a competitive edge. What separates you from the market? When an organization is hiring, why should they hire you over the 30, or 100 other applicants? What’s going to make you stand out? Realizing this was a big shock for me and began to make me feel like I was not very special at all. But remember that often what is a competitive is having a combination of skills. Maybe you’re not the best programmer, but maybe your family background is running a landscaping business, so maybe you can work for some sort of landscape management software company. Maybe you can start one. Every one of us are unique in our backgrounds, experiences, interests, and skills. It is our responsibility to communicate that to the world and make others understand the value that we have to offer. It is even more important to realize what our value is ourselves, before we can even communicate that with others.

Plan to Adapt

ABZ Planning is a concept introduced by Hoffman and Casnocha. Point A is where you’re at now, point B is where you are sort of interested and you’re keeping your eye on, and plan Z is your fallback plan. Where you’re at now, you should have a clear idea about what to do and where the market is at. Point B is just a rough idea, you don’t need to make specific plans for it because it’ll always change. Plan Z is your fallback (bar tending, starbucks, etc). Plan Z should be a viable option so that you are able to take care of your basic needs if all else goes wrong.

It Takes a Network

I^We is the concept that your individual skills matter, but your ability to connect with others is just as important. When you have great skills and a strong network, your individual skills are exponentially magnified to the market.

In order to develop a network, you need to be completely natural at developing strong relationships, where the focal point is not “what can I get from you” but “how can I help you and understand your perspective.”

An interesting note about your network, is that in a survey, 16% of respondents had referrals from close friends that they had regular contact. 55% from weak ties that they irregularly talked with and 27% were from acquaintances that they barely talked to.

On reaching your extended network they suggest to really do your research before reaching out to your extended network. Your extended network can be powerful resource for you to tap into if you really know how to draw from it. Do your research and make some sort of common connection.

Pursue Breakout Opportunities

“Entrepreneurs don’t start businesses just anywhere; they channel the mind-set and skills we’ve been discussing into finding the great business opportunities. Likewise, in order to accomplish something significant in your career, you need to focus on finding and capitalizing on those great career opportunities: the opportunities that will extend your competitive advantage and accelerate your Plan A or Plan B.”

Breakout opportunities are keys to everyone’s careers, it might even be conceivable that the people with the most success either have the biggest breakout opportunities and/or the most breakout opportunities. Breakout opportunities are normally big projects or big clients that end up giving you a huge boost in experience and self confidence.

In order to catch these opportunities the authors suggest to court good randomness and serendipity. When you court serendipity and good randomness, you are simply opening yourself up to more opportunities that might come by as potential breakout opportunities for you! You can do this by simply joining clubs, networks, meet ups, connecting with your alumni, or even simple things like going to dinner parties where you don’t know anyone. The point is, is that when you open yourself to opportunities, they will land. Many of our past opportunities that we have experienced already came from favours from people or random chance. If you’re able to make yourself available and accessible and keep your eyes open and open yourself up to opportunities, you will be bound to catch breaks.

Take Intelligent Risks

There is a common misconception that entrepreneurs are massive risk takers. Which in a sense is true, many entrepreneurs are like cowboys in a rodeo and swinging for the fences. However the best entrepreneurs do not necessarily have a huge tolerance for risk, but they are able to manage it well. They can assess the upside and decide whether it is worth the downside risk. For example, Richard Branson when he started Virgin Atlantic, was able to negotiate an unbelievable return policy with Boeing which ended up rendering his downside risk minimally. This gave him the confidence to be able to really go after such a big venture.

As humans, we are generally quite poor at managing and assessing risk. That is because biologically we are wired to worry about our survival and our self preservation a lot more than looking for opportunities to grow. However, armed with this knowledge, we can do better to assess risk. Really look at it and decide what is the worst thing that could happen. If the worst that you could happen is you lose your job, or lose some money, if you have a plan Z in place, you should be able to handle intelligent risks.

Opportunities that others might find risky but aren’t as risky, can be found in situations such as jobs with lower pay but tremendous learning opportunity, taking up contract jobs since they are less stable, or in any position that is highly publicized as high risk. Usually those jobs are not as high risk as the public makes it to be.

Another great recommendation by Hoffman and Casnocha on risk is to introduce small volatility throughout your career to put yourself in uncomfortable positions. This is actually the smartest for those who are the most risk averse, because you begin to build up your defences to volatility. It is almost a certainty that we will go through another recession or difficult time in our lifetime. When you are not used to volatility or risk or failure at all, when catastrophic events occur, you will be caught completely off guard and will be affected most by these events. However, those who experience regular volatility are equipped best to maneuver and react any time doors close or unfortunate circumstances occur.

“For the start-up of you, the only long-term answer to risk is resilience.

Remember: If you don’t find risk, risk will find you.”

Who You Know is What You Know

Speaking further about your network, I^We is re-emphasized. This chapter is about being able to call on help or advice when it’s needed. Not necessarily looking for opportunities as much, but to gain information. There is invaluable information with people when you are able to tap into their experiences and knowledge. People are the first to know what’s on the ground and what’s happening with an industry. Other people will have knowledge and experience and can cater information specifically to your context. Smart people are able to give you valuable advice from outside perspectives. By being able to tap into your network during specific situations, you are able to draw a wealth of information from different sources and then synthesize the information in order to form actionable steps. This is especially helpful when it occurs when you have a large decision.

Additional Notes:

In the concluding chapter I thought there was a interesting note speaking to the society that you live in. The health of a society can play a large factor when you compare a fearful and society in poverty, the opportunities and the environment does not make it conducive to healthy networks that are willing to give and share. Whereas in areas with healthy societies, there are great groups, industries, meet ups in order to join in and share knowledge and connections and introductions with one another.